german tax calculator married

This is a sample tax calculation for the year 2021. Starts at a marginal rate of 14 and progressively increases to 42.

75000 EUR 0 EUR 75000 EUR.

. Rental income from German sources of one spouse totals a loss of EUR 5000. First add your freelancer income and business expenses to the calculator. Under joint tax filing in Germany the income of the spousescivil partners is determined separately but then added together and submitted to the tax office as a joint income tax return.

The calculation is an illustration based on various assumptions and isRead More Germany Salary Tax Calculator 2022. Have been doing my income tax return via Wundertax for two years and its very well written and easy to use. Fill in the relevant information in the Germany salary calculator below and we will prepare a free salary calculation for you including all costs that are incurred.

An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488. There are six tax classes in Germany. Married couples who are permanently separated as well as widowed persons are also covered by tax class I.

Thank you for your well thought-out system. Unemployment Insurance is a social security tax and it represents 12. No employment related expenses exceeding the lump sum allowance of EUR 1000.

About the 2020 german income tax calculator. With this tax rate however only the income without parental allowance is taxed so that the tax amounts to 5044 Euro. If married AND couple taxation is opted for first both incomes are added up.

Calculate your tax using the German Income Tax Calculator. Your respective tax office will assign you a tax bracket. It is very easy to use this German freelancer tax calculator.

Here are the most important features of Ehegattensplitting joint tax assessment. The child allowance for 2019 is 7620 for a joint tax return or 3810 per parent. Income from 57919 to 274613.

Married couple with two dependent children under age 18 years. If your income tax is more than 16 956 euros per year the solidarity surcharge rate is 55 of your income tax. Whether its a diesel petrol or electric car motorcycle truck or camper.

In 2021 above 274612 year the 2007 new created income tax riche tax is 45 tax above 274612. An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488. A flat corporate income tax rate is 15 plus a surtax of 55 applies to the resident and non-resident companies on the profits after the deduction of business expenses.

Pension Insurance is a social security tax and it represents 93 of your income. In addition to this the municipal trade tax is added at the rate ranging between 14 and. This will generate your estimated amount for your Profit and Loss statement.

Motor vehicle tax calculator. Gross salary of one spouse of EUR 100000 other spouse has no income. There are 6 tax brackets Steuerklassen in Germany.

As you can see above the tax allowance is double for a married person. Then divided by two. Husband John earns 75000 EUR taxable income his wife Mary earns 0.

In germany see the bundesministerium der finanzen. For married couples the same formula is used but with the difference that for only the half of the income the tax is calculated and afterwards this tax is then doubled which is an advantage in the progressive tax rate. There is also a top tax rate of 45 for very.

With our calculator for motor vehicle taxes you know before buying how tax is due for your new vehicle. If you only have income as self employed from a trade or from a rental property you will get a more accurate. 6000 19970 tax 4391.

The basic principal is that income is divided between couples to calculate income tax liability. Without a progression reservation the tax for an income of 26000 Euro would be only 4333 Euro. You can calculate corporation tax online using the German Corporation Tax Calculator.

In return the income tax would amount to 6198 Euro which corresponds to a tax rate of 194 percent. As you may imagine not every citizen is in the same tax bracket. 2022 2021 and earlier.

Online Calculators for German Taxes. Income from 0 to 9744. The tax bracket Steuerklassen you end up in is dependent on your marital status.

Please enter a valid email address as you will be sent an email with a calculation. Start tax class calculator for married couples. The tax range between the income levels is called progressive tax.

Both are considered as one tax-paying unit and receive a joint tax assessment. Income from 9744 to 57918. The surcharge is imposed as a percentage on all individual income taxes.

For 2017 it is 7356 or 3678. The chart below will automatically visualise your estimated net and gross income. For example an employer can calculate an employees income tax Lohnsteuer by means of the tax brackets.

I could complete my tax return myself with it. This Wage Tax Calculator is best suited if you receive a salary only as an employee on a German payroll. This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022.

If not married Johns tax would be 42 x 75000 EUR - 878090 EUR 22719 EUR. Gross Net Calculator 2022 of the German Wage Tax System. Income tax solidarity surcharge pension insurance unemployment insurance health insurance care insurance.

German Wage Tax Calculator Expat Tax. Income up to 9984 euros in 2022 is tax-free Grundfreibetrag. Tax class II takes into consideration an.

For 2018 it is 7428 or 3714. Then add your private expenses to calculate your taxable income. I can only recommend it.

The German Tax calculator is a free online tax calculator updated for the 2022 Tax Year. Tax class I applies to persons who are unmarried or divorced and also to married persons whose spouse lives abroad and to couples registered in a civil partnership. This report is called Anlage EÜR in German.

2021 German Tax rates at a glance.

Irs Form 1116 Foreign Tax Credit With An Example 1040 Abroad

Set Up Direct Deposit With The Irs When You File Today Here S Why Cnet

City Of Chandler And Mesa United Way Offer Free Tax Preparation Assistance City Of Chandler

Budget 2022 Income Tax Calculator Assumptions Kpmg Ireland

Irs Form 1116 Foreign Tax Credit With An Example 1040 Abroad

Landmark Mortgage Rates Lowest Mortgage Rates Online Mortgage Mortgage Rates

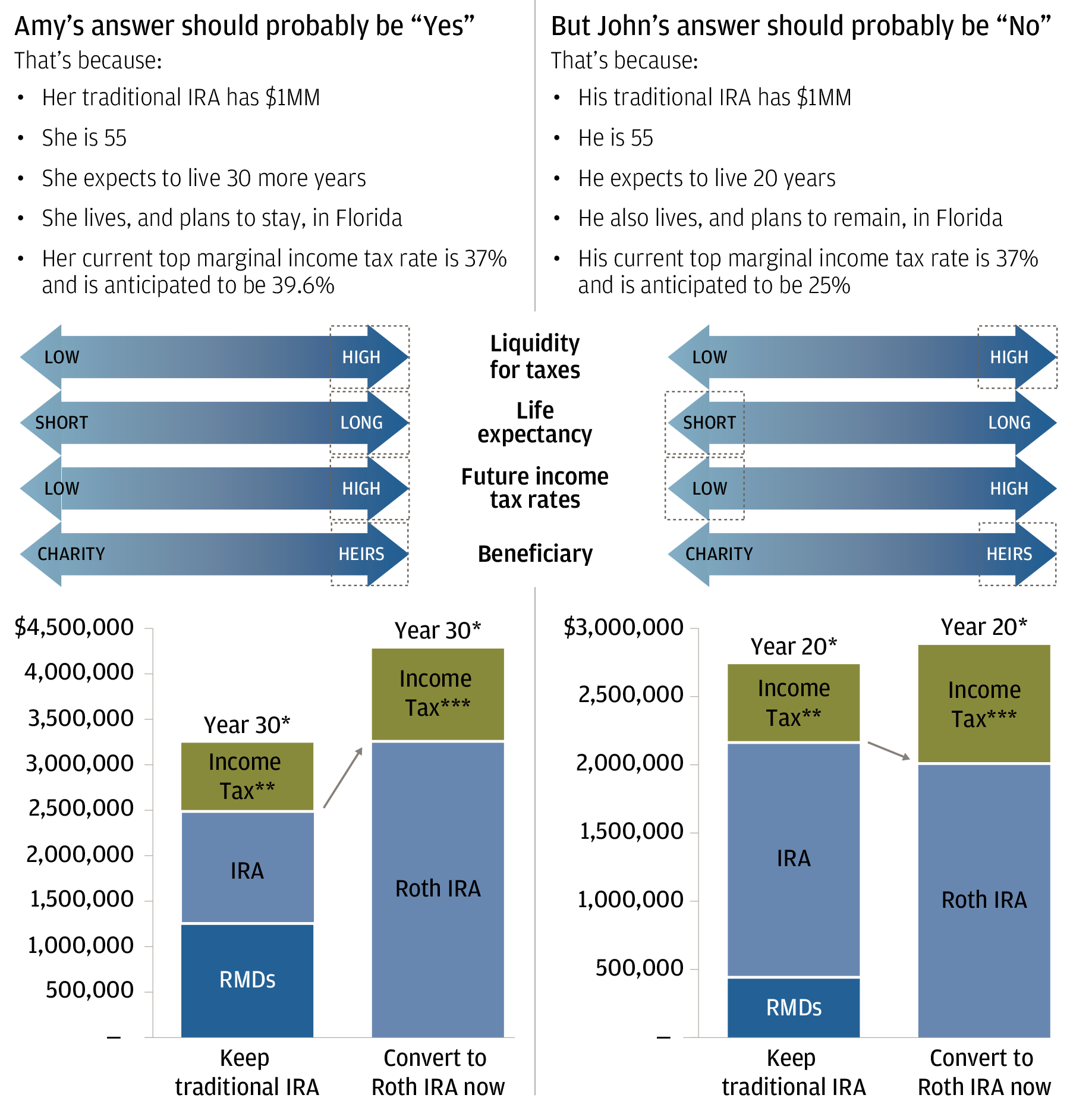

Think Roth Ira J P Morgan Private Bank

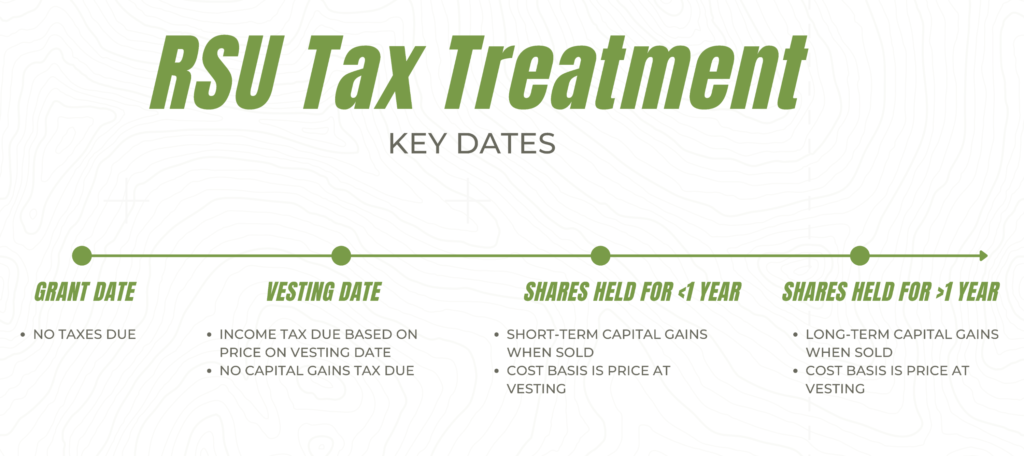

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Second Hand New International Tax Advisor Tax Advisor Post Free Ads Advisor

Landmark Mortgage Rates Lowest Mortgage Rates Online Mortgage Mortgage Rates

Irs Form 1116 Foreign Tax Credit With An Example 1040 Abroad

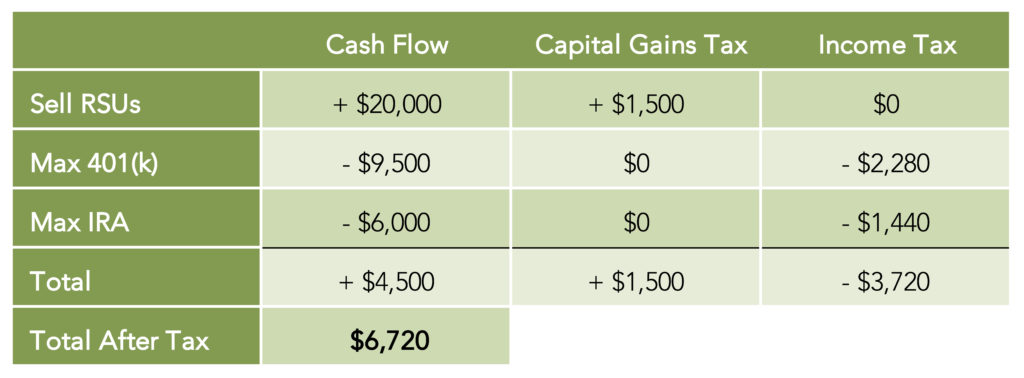

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Italian Tax Code Codice Fiscale Studio Legale Metta

Solar Light On Twitter Solar Light Bulb Decorative Solar Lights Solar Lamp Post

Money Matters Reasons For Tax Refund Delays Wv News Wvnews Com

Expert Tax Tips Verified By Us Expat Tax Professionals Myexpattaxes

Irs Form 1116 Foreign Tax Credit With An Example 1040 Abroad