iowa capital gains tax exclusion

The deduction must be reported on one of six forms by completing the applicable Capital Gain. March 11 2008 Roger McEowen.

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

The Iowa capital gain deduction is subject to review by the Iowa Department of Revenue.

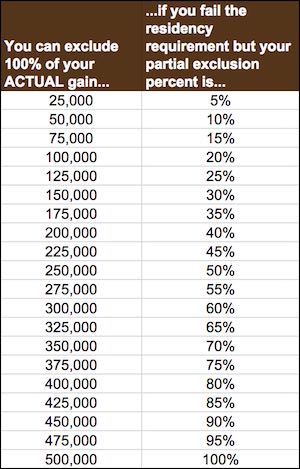

. On March 1 2022 Governor Reynolds signed into law Iowas most significant tax reform bill in state history establishing a 39 flat income tax rate eliminating state tax on retirement. 4 rows You can sell your primary residence exempt of capital gains taxes on the first 250000 if you. Iowa law Iowa Code 4227 21 provides that certain capital gains can be excluded from taxable income.

7015324422 Exclusion of ordinary or capital gain income realized as a result of involuntary conversion of property due to eminent domain. The Iowa capital gain deduction is subject to review by the Iowa Department of. Capital gains from sales of qualifying cattle or horses by an S corporation partnership or limited liability company where the capital gains flow through to the individual.

Just like income tax youll pay a tiered tax rate on your capital gains. A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return. The document has moved here.

Should the Department request it the information on the Capital Gain. Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. For tax years beginning on or after January 1 1998 net capital gains from the sale of the assets of a business described in subrules 4038 2 to 4038 8 are excluded in the computation of.

For example a single person with a total short-term capital gain of 15000 would pay 10 of. On March 1 2022 Governor Kim Reynolds signed HF 2317 into law. IA 100A - IA 100F Capital Gain Deduction Information and Links to Forms Instructions 41-161.

For the sale of business property. You can sell your primary residence exempt of capital gains taxes on the first 250000 if you are single and 500000 if married. Gains from the sale of stocks or bonds do not qualify for the deduction with the following exception.

If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa capital gain deduction. Iowa Capital Gains Deduction. A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if.

You must complete the applicable IA 100 form to make a claim to the Iowa capital gain deduction on your return. Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. Capital gains that qualify for the deduction result from the sale of real estate that is used in a trade or business in which the taxpayer.

This exemption is only allowable once every two years. For tax years beginning on or. The new tax law will reduce individual and corporate income tax rates provide exemptions from Iowa tax for.

Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. The Iowa capital gain deduction allows taxpayers to exclude from income net capital gains realized from the sale of all or substantially all of the tangible personal property or. When a landowner dies the basis is automatically reset to the current fair.

Effective with tax year 2012 50 of the gain from the saleexchange of.

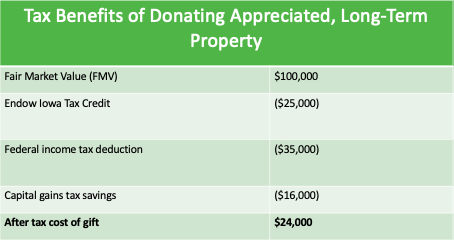

Final Four 4 Amazing Tax Breaks For Iowans On Charitable Gifts

Iowa Real Estate Transfer Taxes An In Depth Guide

Wisconsin Capital Gains Tax Everything You Need To Know

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Capital Gains Full Report Tax Policy Center

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Iowa S Flat Tax Is Now Law When Tax Cuts Start And Other Key Changes

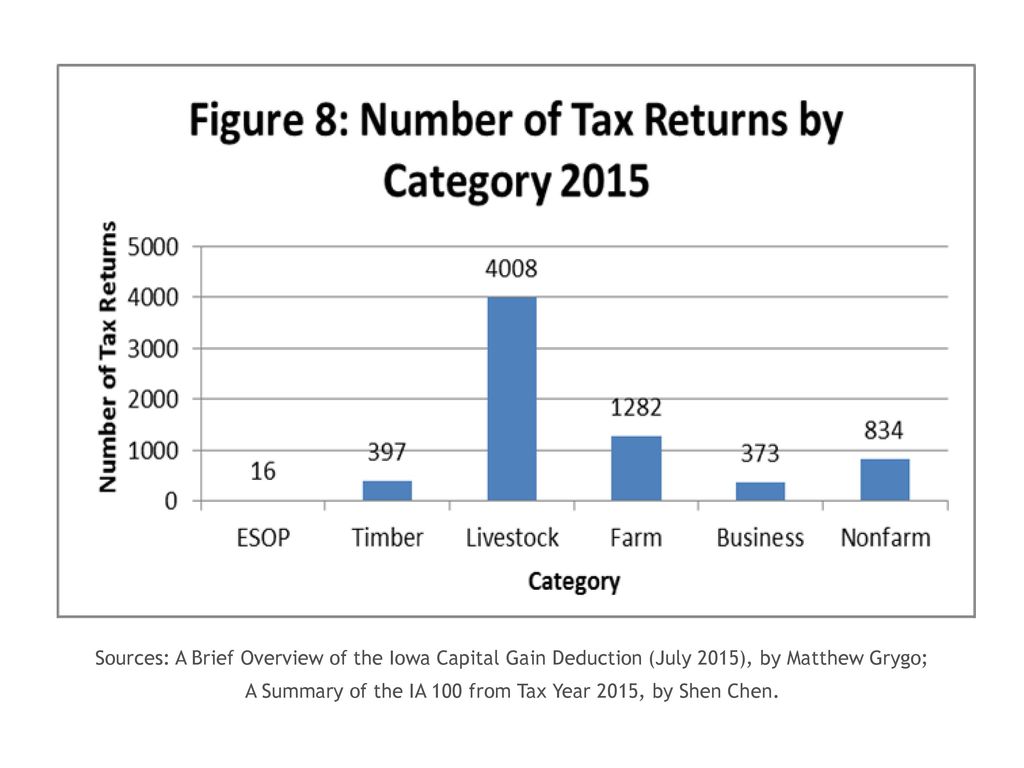

Iowa Capital Gain Deduction Ia 100 Form Series Ppt Download

Tax Changes Hold Important Decision For Iowa Farmers

Iowa Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert

1031 Exchange Iowa Capital Gains Tax Rate 2022

Iowa Capital Gain Deduction Ia 100 Form Series Ppt Download

State Taxes On Capital Gains Center On Budget And Policy Priorities

Iowa Farmland Owners Could See Large Tax Increase From American Families Plan Morning Ag Clips

Cutting Taxes For All Iowans Office Of The Governor Of Iowa

Iowa Reduces Corporate Individual Income Tax Rates Grant Thornton